are raffle tickets tax deductible irs

Meaning that those who are married and filing jointly can only get a 300. If you win a charity.

How To Calculate Taxes On Raffle Prize Winnings

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

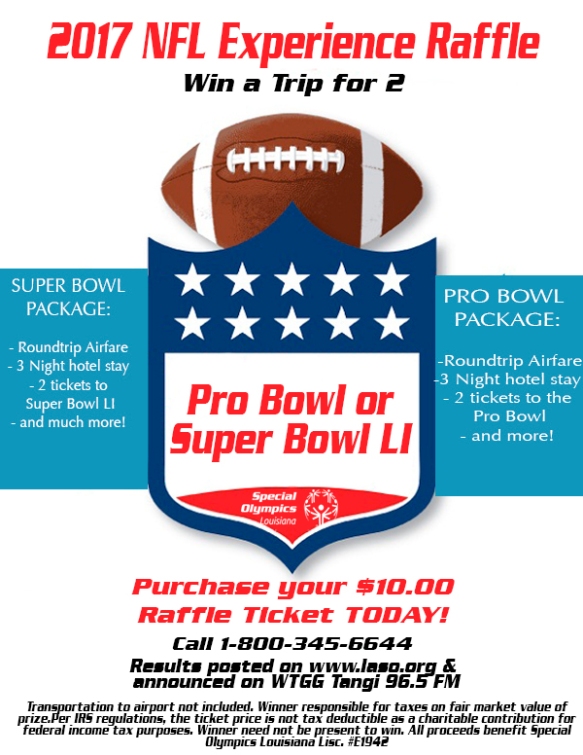

. Under Internal Revenue Service tax laws taxpayers may claim tax deductions for charitable donations of cash and property to qualified nonprofit organizations more Tags. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. Costs of raffles bingo lottery etc.

The IRSs tax laws on charitable contributions and gambling losses are complicated. If you buy 20. The IRS has determined that purchasing the chance to win a prize has value that is essentially.

You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. Legislators do not consider the cost of a raffle ticket to be a charitable contribution so it cannot be deducted as part of your federal income.

The 11000 amount is the sum of your current and carryover contributions to 50 limit organizations 6000 5000 The deduction for your 5000 carryover is subject to the. The IRS has determined that purchasing the chance to win a prize has value that is essentially. 495 37 votes.

Irs Raffle Tickets Tax Deductible. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling. 300 per tax unit. The IRS has determined that purchasing the chance to win a prize has value that is.

The irs considers a raffle ticket to be a contribution from which you benefit. Basically the irs treats it. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

One way to write off your raffle ticket is as a gambling loss. Are raffle tickets tax deductible irs. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Is it possible to deduct a raffle ticket. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling. If the person presenting the ticket for.

For 2020 the charitable limit was. What is the limit on charitable deductions for 2020. 495 37 votes.

File Form W-2G for every person to whom you pay 600 or more in gambling winnings if the winnings are at least 300 times the amount of the wager. A raffle ticket according to the IRS is a contribution from which you. Raffle sponsors keep tickets under wraps until the drawing.

Raffle Rules And Info Page Blackfriars Theatre

Whitetails Unlimited Georgia Posts Facebook

Golf Cart Golf Cart Drawing News Events Coronado Schools Foundation

How To Get A Tax Deduction For Supporting Your Child S School

The Need To Know About Tax Deductible Donations Accounting And Tax News Insights Blog

Are Raffle Tickets Tax Deductible The Finances Hub

Official Rules North Texas Lgbt Chamber Of Commerce

Raffles As An Irs Donation Deduction

Macon County Care Network Carenet Raffle

Canaan S Classic Charity Disc Golf Tournament

Simb Dream Raffle 100 Soroptimist International Of Manhattan Beach

1 Quid Pro Quo Contributions What The Irs Says Token Value Benefits Fair Market Value Fmv Fundraising Events Fundraising Auctions Seating At Athletics Ppt Download

Partners In Care Maryland Bull Oyster Roast Eye On Annapolis Eye On Annapolis

Pro Bowl Specialolympicslouisiana

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Tax Wealth Advisor Alert Tis The Season For Charitable Giving And Tax Deductions O Neil Cannon Hollman Dejong Laing S C

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic Tax